iGenius is an US MLM company owned by SEC registered parent company Investview.

Curiously, you won’t find any information about CoinRule or iGenius’ new automated trading passive returns investment opportunity on its website.

For more information we turn to a recent marketing presentation given by Investview and iGenius President, Chad Garner.

[8:23] CoinRule, these guys they essentially create software that connects to your crypto exchange account.

And the software can also execute trades. You give it basically authorization to execute trades on your behalf, and so you can have automated trading take place in your exchange account.

This is the “lulz can’t touch our money!” model. It’s the same model used with EndoTech, another passive returns investment scheme iGenius charges for access to.

Under the “lulz can’t touch our money!” model, an MLM company’s customers place their funds under control of a central entity. In this case its “Cforce”, a purported “exclusive” trading bot CoinRule provides to iGenius.

As further explained by top iGenius promoter and Florida resident Anthony Napolitano;

[11:57] This is a software company called CoinRule. They actually created this third-party product suite for us. And it gave us basically access to an exclusive strategy called Cforce.

Cforce … basically seeks trends in the market, in the crypto market, and it completely automates the trading experience.

[12:15] You have full custody of your money at all times. You never give your money to anyone.

But as an iGenius member you have the ability to link your exchange account, whatever exchange you prefer to use, to this technology.

And this technology has the ability to automate trades 100%, 24/7, seven days of the week.

“Lulz can’t touch our money!” trading schemes typically implode through bad or rigged trades. I can’t speak specifically to CoinRule but bot owners typically steal client funds through rigged trades and blame it on hackers, or disappear etc.

Here’s how CoinRule handles investor losses;

Limitation of Liability

11.1 Coinrule shall not be liable for any direct, indirect, incidental, special, or consequential damages arising out of or in connection with the use or inability to use the Software, even if Coinrule has been advised of the possibility of such damages.

11.2 In no event shall Coinrule’s total liability to you for all damages, losses, and causes of action (whether in contract, tort, including, but not limited to, negligence, or otherwise) exceed the amount paid by you, if any, for accessing the Software.

Access to Cforce requires an “Elite” iGenius membership.

An Elite iGenius membership will set you back $1499.99 and then $174.99 a month. Access to Cforce is an additional $315 annually on top of that.

CoinRule launched its passive returns automated trading scheme in 2021. CoinRule appears to be UK based and is headed up by CEO Gabriele Musella.

CoinRule sells memberships on its website starting at no cost and topping out at $449.99 a month.

On its website, CoinRule also advertises a $200 referral program. Presumably this means iGenius gets an undisclosed kickback per Elite member they sign up.

I believe the FCA’s banning of “refer a friend” schemes by “cryptoasset” companies doesn’t apply to CoinRule. CoinRule doesn’t appear to offer any cryptoassets to consumers.

That said CoinRule’s passive returns investment opportunity through automated trading should be registered with the FCA.

A search of the Financial Services Register reveals CoinRule is not registered with the FCA. This makes CoinRule an “unauthorised firm” in the UK.

As per CoinRule’s website Terms and Conditions;

These Terms of Use shall be governed by and construed in accordance with the laws of England and Wales, without regard to its conflict of law principles.

By failing to register its passive returns investment opportunity with the FCA, CoinRule is committing verifiable securities fraud in its home jurisdiction.

As tracked by SimilarWeb, as of May 2024 the largest source of traffic to CoinRule’s website is US residents (39% of traffic).

CoinRule openly disclose they are not registered with the SEC either:

Why there’s no mention of CoinRule or Cforth on iGenius’ website is unclear. There’s also no mention of EndoTech, another company iGenius provides similar passive returns through.

Without providing any verifiable proof (audited financial reports), Napolitano pitches potential investors on CoinRule’s purported historical results.

[13:34] I can tell you this tech has done extraordinarily well. Our members do truly love it.

Investview is currently under SEC investigation for suspected iGenius related fraud. Investview’s former CEO has also been incarcerated following multiple convictions on unrelated fraud charges.

Under US law (the Howey Test), the passive returns iGenius markets through CoinRule’s automated trading bot constitute a securities offering.

iGenius client investors place their money under control of Cforce, which is owned and operated by a common enterprise (CoinRule).

This is done on the “reasonable expectation of profits to be derived from the efforts of others” (returns generated via automated trading through CoinRule’s bot).

With all prongs of the Howey Test satisfied, iGenius’ passive returns offered through CoinRule constitute a securities offering.

There is no mention of CoinRule in its last two SEC filings; an annual 10-K filed last December and a quarterly 10-Q filed on May 14th, 2024.

Both of iGenius’ CoinRule and Endotech securities offerings are simply reduced to;

iGenius members also gain access to a variety of benefits provided through third party partnerships and affinity arrangements, including access to a crypto trading software and a digital wallet platform.

Between hiding information on its website and in its SEC filings, consumers are left unable to make an informed decision about investing in iGenius’ offered passive returns trading schemes.

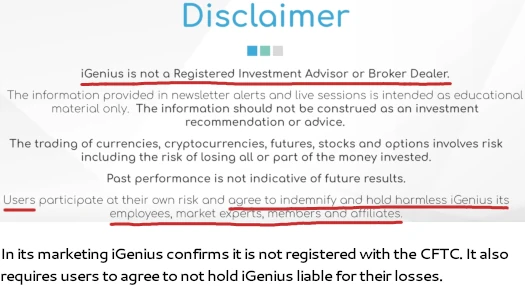

That iGenius offers passive returns through trading also requires it to be registered with the CFTC. A search of the NFA’s BASIC database confirms neither iGenius, Investview or CoinRule are registered.

The CFTC fined Wealth Generators $150,000 for commodities fraud in 2018. See if this sounds familiar;

Wealth Generators also offered an algorithmic trading system to its customers through its Multiplier, Multiplier 2.0, and RYZE products.

These products allowed customers to link to a third-party trading platform operated by an off-shore retail forex exchange, where customers funded accounts that were traded automatically by an algorithmic trading system.

Customers had no discretion to direct trades using these products.

After the CFTC fine Investview renamed Wealth Generators to Kuvera. Following widespread investor losses through trading bots, Investview renamed Kuvera to iGenius in early 2021.

Perhaps aware that neither Investview hasn’t registered its latest passive returns investment scheme with the SEC, and that neither Investview, iGenius or CoinRule are registered with the CFTC, Napolitano trots out this pseudo-compliance;

[12:47] To make this very clear as well, I’m gonna reiterate it this; CoinRule is a third-party company.

iGenius is not the one providing this software, CoinRule is.

Which is of course baloney…

[13:50] There’s no way you can get access to this tech without being a part of iGenius.

iGenius affiliates connect and participate with CoinRule’s unregistered investment scheme through their iGenius backoffice.

Internally the offer has been named “COINpro”, and it’s exclusive to iGenius;

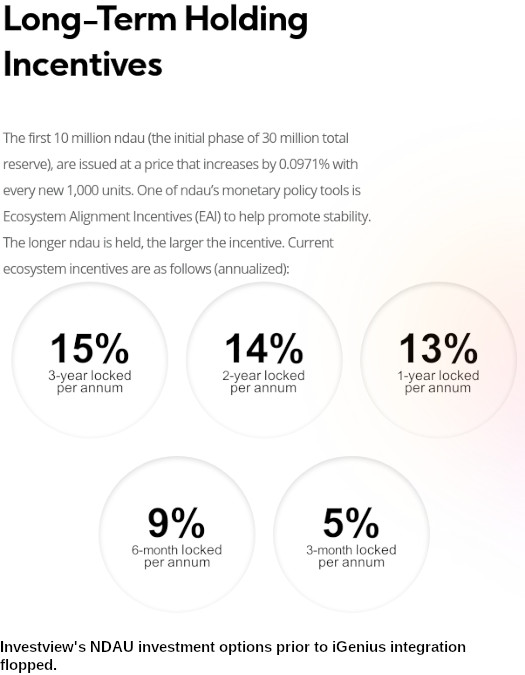

Another component of Kuver and iGenius worth mentioning is Investview’s fraudulent NDAU token investment scheme.

Investview’s SEC filings explain its NDAU investment scheme was dropped due to Total Protection Plus (TPP) regulatory concerns.

Through August 2023, we generated revenue from the sale of cryptocurrency packages to our customers through an arrangement with a third-party supplier, certain of which, until January 2022, included a product protection option provided by a third-party provider.

According to marketing and legal documents provided by such third-party provider, the product protection would allow the purchaser to protect its initial purchase price by obtaining 50% of its purchase price at five years or 100% of its purchase price at ten years.

In January 2022, we suspended any further offering of the product protection option in the cryptocurrency packages after the third-party provider was unable to comply with our standard vendor compliance protocols, citing certain offshore confidentiality entitlements.

That suspension will remain in place until we are able to further validate the continued integrity of the product protection and the vendor’s ability to honor its commitments to our members.

We cannot ensure that such third-party provider will comply with its contractual requirements, which could cause our members to not achieve the level of return on their investments expected.

While we do not believe that we have any legal responsibility to the customers who participated in the TPP Program offered and administered by TPP, there is a risk that any failure of TPP to perform its obligations to our customers, could expose us to claims of our customers that could have an adverse effect on our business, financial condition, and operating results.

iGenius operates from two website domains; “igeniusglobal.com” and “igenius.biz”.

As of May 2024, SimilarWeb tracked top sources of traffic to iGenius’ websites as:

- “igeniusglobal.com” (~46,200 monthly visits) – Germany (16%), Poland (13%), Albania (8%), Jordan (8%) and France (7%)

- “igenius.biz” (~541,600 monthly visits) – Poland (56%), Germany (14%), Jordan (5%), the US (4%) and Saudi Arabia (4%)

Authorities in Poland announced an iGenius pyramid fraud investigation last September.

iGenius failing to retain a sizeable customer base in the US since 2021 is a major due-diligence red flag.